Table of Contents:

Before we start, if you are here to get the FREE stop-loss indicator, you can go straight to: https://www.tradingview.com/script/FEHRN9u7-Trend-Surfers-Fix-Stoploss-Picker/

If you want to learn a bit, continue reading 🙂

What is a stop loss?

The stop loss is a predetermined price or coin value at which your position will be closed. For example, if you buy Ethereum at 1000 USDT and set a stop loss at 900 USDT, once the price reach 900 USDT, your position for Ethereum will be close with a 10% loss.

The stop loss is there to protect your equity if the market doesn’t go in the direction of your position.

You should always set a stop loss value before you enter any position. If you don’t, you are looking for trouble, especially in volatile markets like cryptocurrency.

How to set up a stop loss?

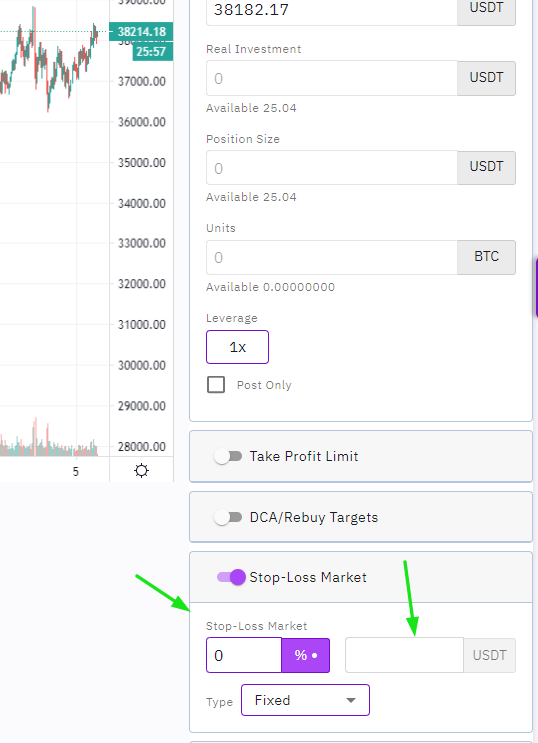

Most crypto exchanges will have an input setting for you to enter your stop-loss price. If they don’t, you can use a smart trading platform like Zignaly to manage your positions instead of trading directly on the exchange.

When entering a new position, simply fill the stop-loss input with your pre-determined value.

This is an example of stop-loss input field for the Zignaly smart trading terminal:

How to choose the right stop-loss?

There is no strict rules as to where to put your stop-loss. it should be mostly based on how your strategy is design and what kind of movement would invalidate your position. But there is certainly some basic stop-loss settings that could lead you in the good path.

Many crypto and stock traders will use the ATR (average true range), Highs & lows, or pivot points in order to determine their stop-loss price value.

ATR for your crypto Stop-Loss

The ATR (Average True Range) formula is a technical analysis tool that is used to measure volatility in the market. The ATR is calculated using a formula that takes into account the current and previous highs and lows of an asset’s price. The formula is as follows:

ATR = [(Current High – Current Low) + (Current High – Previous Close) + (Current Low – Previous Close)] / 3Don’t worry, the stoploss script take care of this for you.

The ATR formula calculates the average range of an asset’s price movement over a specified period, which is typically 14 days. This range represents the asset’s volatility, and traders use the ATR to determine the potential risk and reward of a trade. The higher the ATR value, the more volatile the market, and the more risk involved in the trade. Conversely, a lower ATR value indicates lower volatility and less risk. The ATR formula is a useful tool for traders who are looking to manage their risk and optimize their trading strategies.

How to use the ATR as your crypto stoploss?

The ATR or Average True Range is a volatility indicator that tells you how much a crypto moved in average for a preset time-frame.

For example, if bitcoin is currently at 30K USDT and the ATR is at 2k USDT. I could do 30,000 – 2,000 = 28,000 USDT and use 28, 000 USDT for my stop-loss.

If the price gets lower than the entry price minus an ATR, it could mean that the market has started to move against your position.

The ATR indicator would probably work best as a trailing-stop-loss but it will certainly not hurt to use it as a fix stop-loss.

Here’s what the ATR +/- the current price looks like on a chart:

When used as a fix stop-loss, enter the value of (Current price – ATR) for a Long position or (Current price + ATR) for a short position. Always use the preceding closed candle to determine your ATR stop-loss value as the current candle will not have a fix ATR value.

Highs & Lows as a stop-loss

Another popular stop-loss is to use the highest high or the lowest low of a predefined time frame. For example, you could use the Highest high of 30 days for a short or the lowest low of 30 days for a long to find out your stop-loss value.

The timeframe would vary depending on what definition you are trading. I wouldn’t use a 30 days stop-loss while trading on a 15 minutes chart, you would instead might want to use a 4 hours or 1 day high or low.

Here is what the High-Low stop-loss would look like on a chart:

As you would use this as a fixed stop-loss, it is important to use the value provided on the current candle. Unlike the ATR, the High and Low stop-loss value will not change during the current candle unless you look at the high-low of that candle to determine your stop-loss, but that would be stupid 😉

*If the current candle if outside of the High-Low range, you can use the previous high or low as a stop-loss.

Pivot points as a stop-loss

The pivot points are very similar to the high & low stop-loss, but will defer from time to time. Some will prefer that as it can often get closer to the current trading price, making your stop-loss tighter.

A pivot point is created by look at X bars on the left side and X bars on the right side. So let’s say 10 bar on each side to simplify things.

If we look at a Pivot high, once the high of a candle is higher than the 10 last candle on the left and their is now 10 new candle on the right side that are lower, a new pivot point will be created.

The pivot point will indicate you the Highest or lowest point where the market as turned. Using this to set your stop-loss would be beneficial as pivot break is generally meaning that thecrypto market is heading in the opposite direction.

Use the Pivot High as a Short stop-loss and the Pivot low as a Long stop-loss.

Here’s an example of Pivot point on a bitcoin chart:

*If the current candle if outside of the Pivot high or pivot low range, you can use the previous pivot as a stop-loss.

Free Stop-loss indicator for crypto

If you would like to use our free indicator for Tradingview, that will let you know what your stop-loss should be for ATR, High-Low and Pivot, please go to https://www.tradingview.com/script/FEHRN9u7-Trend-Surfers-Fix-Stoploss-Picker/

From there, you will be able to add the script to your Favorites and use it for your crypto trading.

Here’s what the script look like on a chart:

Please let me know in the comment if you would like to see other stop-loss indicators inside the script!

The importance of having a stop loss for crypto trading

Stop loss orders are an essential tool for any crypto trader. They help limit your losses by automatically selling your assets if their value drops to a predetermined price. Essentially, stop loss orders act as a safety net that prevents you from losing more money than you’re comfortable with.

Let’s say you bought some Bitcoin at $60,000, hoping it would increase in value. Unfortunately, the market takes a turn for the worse, and Bitcoin’s value drops to $50,000. Without a stop loss order, you would be left with two options: either hold on and hope the value goes back up or sell at a loss. But with a stop loss order in place, you could have set the order to trigger at $55,000, ensuring that you would sell the Bitcoin before it could fall any further.

Having a stop loss order in place is especially important in the volatile world of cryptocurrency. Crypto prices can be incredibly unpredictable, and a sudden drop in value could wipe out your entire investment. But with a stop loss order, you can take control of the situation and limit your losses.

Of course, stop loss orders aren’t foolproof. If the market drops rapidly, it’s possible that your stop loss order won’t trigger at the price you set, leaving you with a larger loss than you planned. Additionally, stop loss orders can be triggered by market volatility, which means that your assets could be sold at a lower price than you intended. That’s why it’s essential to use stop loss orders alongside other risk management strategies, such as diversifying your portfolio.

Pro crypto traders and stock traders uses stoploss

Professional traders understand the importance of risk management, and that’s why they use stop loss orders in their trading strategies. The best pro traders see stop loss orders as an essential tool that helps them limit their losses and protect their investments. They understand that the market can be volatile and unpredictable, and having a stop loss order in place can help them avoid devastating losses. In fact, many pro traders recommend using stop loss orders as a standard practice, regardless of the trading strategy or market conditions. By setting stoploss orders, pro traders can focus on making profitable trades, knowing that they have a safety net in place to protect their investments.

Risk Management using a stoploss

Now that you know where to place your stop-loss, you can easily calculate your position size and respect strict risk management while trading the highly volatile crypto markets.

To learn more about position sizing using stoploss, check out our position size calculator tool. The calculator is super easy to use and will give you position size for Long and Short trades as well as all the formulas used to determine it.