Table of Contents:

My best free Bitcoin strategy so far!

I’ve been publishing free strategies and tools to help beginning traders to achieve success in the rough crypto trading sphere for a little while now. But I think that this new free strategy for Bitcoin is the best one so far as it combines our Breakout Strategy with our Stoploss indicator and our position size calculator. This is an all-in-one trading strategy for Bitcoin (BTC), but it also works very nicely with most of the other major cryptocurrencies.

In this post, I will do my best to explain to you how the strategy works, how you can customize it to better fit your trading style, how to receive an email alert every time an action is needed from you, and also make sure that you start using it with the right mindset.

There is money to be made with that strategy, but first, you need to know the strategy and understand everything about it if you want to succeed.

But don’t get me wrong, once you get how it works, it will not require much effort from your side to make this a winning strategy for BTC.

Trend Following type strategy

As our other strategies and tools, this strategy is based on the Trend Following trading style. Trend following works very well with Bitcoin as there are very big trends up and also down. This allows us to make money in Bull and Bear markets.

The downside of Trend following with Bitcoin (as with any other assets) is that the strategy doesn’t perform in a ranging market. In that kind of market, trend following strategies will have drawdowns (equity loss % from all-time-high).

But overall, this Breakout strategy will outperform Bitcoin buy and hold strategy. The drawdown suffered by this strategy will also be smaller than the buy and hold drawdown as well as shorter in duration before returning back to our equity all-time-high.

Here are some key points of Trend Following for Bitcoin:

- Close losing trades rapidly

- Let winning trades run until the trend reverse

- Buy Bitcoin on strength

- Sell Bitcoin on weakness

- Manage risk with position sizing rules

- Ignore all fundamentals (news, hype, fud)

Trading Breakouts on Bitcoin

Breakout trading is one of many trend-following strategy types. Basically, trading breakout means that you open a position once the price of Bitcoin breaks out of some range. It can be a support/resistance level, a pivot point, a trend line that you draw manually for example.

For our free Bitcoin trading strategy, I decided to use Highs and Lows of X bars as a trigger for our entry. I might update the strategy in the future to let you choose what type of breakout you would like to use as a trigger.

Highs Breakout

As I mentioned before, we will buy bitcoin on strength and sell it on weakness.

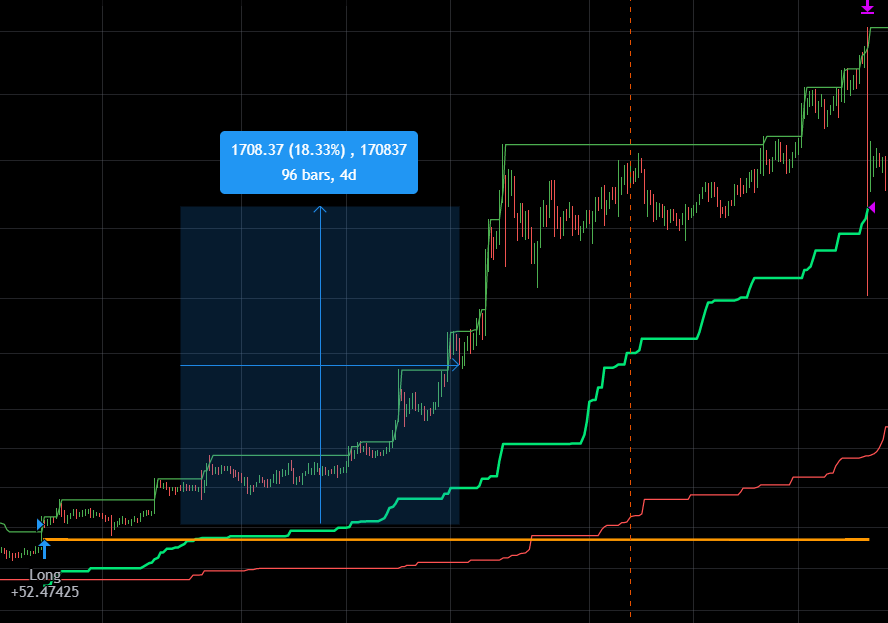

Following this logic, breaking the Highest price of X candles in the past will trigger a Buy order (Long):

The green line on that image represent the highest price of X candles. Once you start using the strategy, you will see that green line following on your chart (I explain below how to do this).

When a Long order is triggered, you will receive an email telling you to buy Bitcoin now as well as all the other information related to the position (stop-loss, position size)

Lows Breakout

Breaking out the lowest price of X candles would result in a selling order (Short). Those are usually less successful than our Long orders, but you can still grow your account a bit or at least protect yourself from a potential downtrend.

I would suggest following Short orders as if they were Long orders even with their lower performance. Our backtest are generated using Long and Short and only trading Long order would alternate the returns expectancy of the strategy.

Average True Range (ATR) for Stoploss and Take profit

For our stop-loss and take-profit, we will be using the Average True Range (ATR).

Using the ATR help the position develop without hitting the stop-loss all the time.

Using a fixed percentage as a stop-loss would not be a good idea as the market volatility is constantly changing. The ATR let us react to that volatility so our stop-loss is always out of the current volatility range.

This gives our position more breathing room.

The same logic applies to our Trailing-Stop/Take-profit. Using the ATR to calculate that value (which will update on every candle) allows the position to grow and react to the changing Bitcoin volatility.

When a new position is triggered, you will receive the stop-loss price with the signal email. The take-profit will not be included as it is changing constantly. You will receive a separate alert to tell you the moment you need to exit your Bitcoin position.

Risk Management will make you a winning trader

When trading Bitcoin, you cannot always use the same amount of USDT for your positions. Your risk % can be the same though. Due to volatility, sometimes the stop-loss will be very closed to our entry price and some other time, it could be very far.

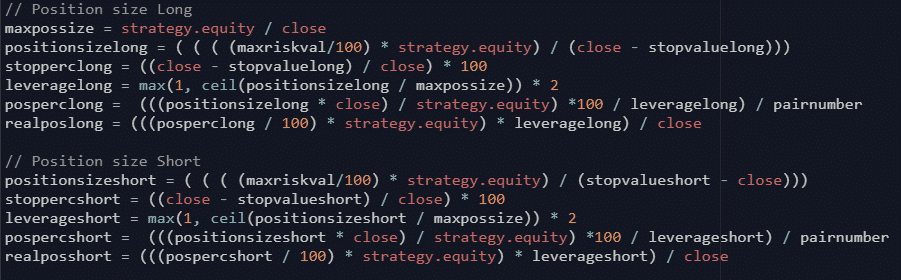

We need to adjust our position size in order to keep our risk percentage the same. The code from the image above is doing just that.

It will use your maximum risk percentage, look at the stop-loss price and tell you exactly how much you should invest when a new position needs to be open.

When a new position is triggered, you will receive the position size and leverage that need to be used.

How to use this free Breakout Strategy on Bitcoin

Ok, enough explanation for now! Let’s get to the fun stuff! I will show you step-by-step how you can add this strategy to a chart, how you can change the settings to test different variations, and the best thing about it, how to receive an email when you need to enter or exit a position.

Ready? Go!

Adding a strategy to Tradingview

To use this strategy and receive email alerts every time you need to enter a Bitcoin position, you will need a Tradingview account (Free).

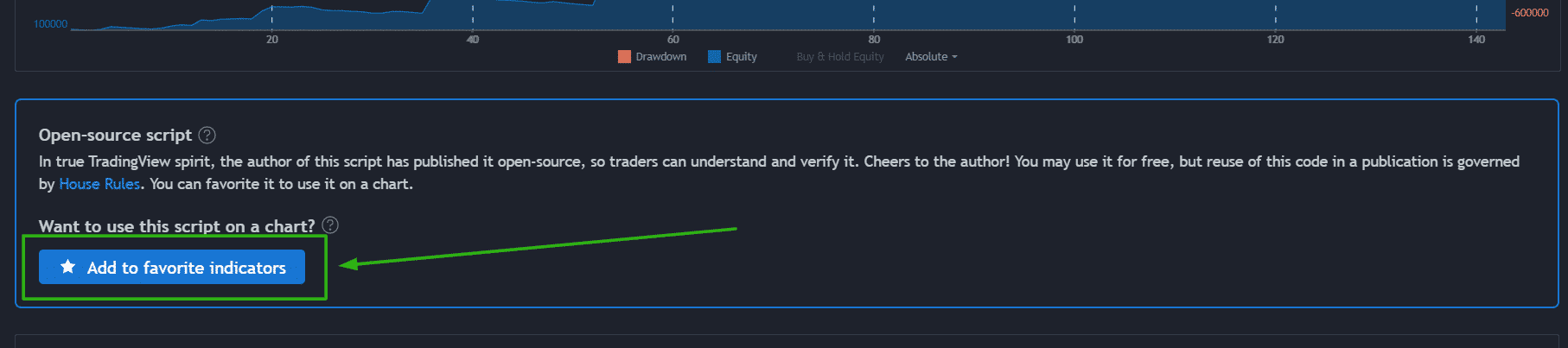

Then you will need to add the Free Bitcoin Breakout Strategy to your favorite scripts.

Scroll down the strategy page, you should see this box:

Once the script is in your favorites, open a Bitcoin chart.

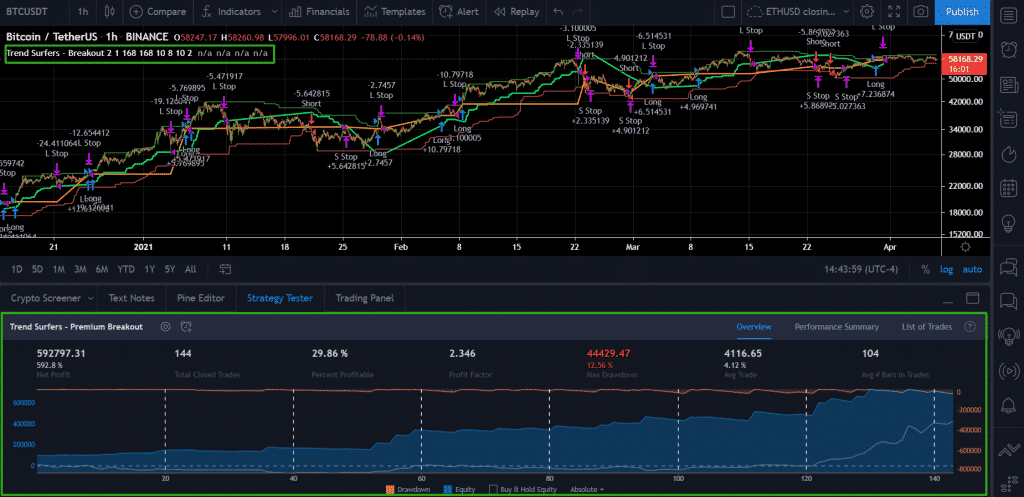

Click on the little arrow on the right side of the Indicators menu and add Trend Surfers – Premium Breakout by clicking on it.

You should now see something like this:

The name of the strategy should be displayed at the top of your tradingview chart and the backtest results for the default values are displayed at the bottom of the chart. If the backtest results are not visible, click on the Strategy Tester tab to open it.

Strategy Settings

Now that you have the strategy on your chart, let’s go around and check out the settings and what is their impact on the strategy. It is very easy but still let’s make sure that everything is clear.

Before we start, open the settings of the strategy by clicking on the Settings button:

Make sure that you are currently viewing the setting box:

All good? Perfect! Now let’s have a look at each field so you can customize the strategy depending on how you want to trade Bitcoin.

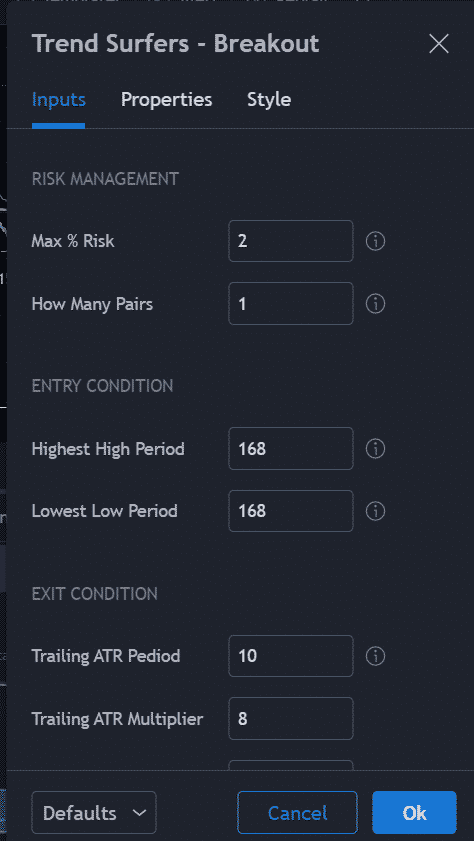

Risk Management Inputs

The strategy uses 2 parameters to create our risk management rules.

- Max % Risk

- How Many Pairs

Max % Risk is the maximum percentage of your total equity that you are willing to risk on every single position. You can play with this input to increase or decrease the position size of each trade. Make sure to check out the backtest results before going to live trading. High-risk % = Big drawdown and greater gains. Low-risk % = Small drawdown and smaller gains.

Do some testing and find the right value for your risk tolerance.

How Many Pairs is the number of pairs that you will be trading simultaneously with the strategy. If you are only trading Bitcoin, leave the number to 1. But if you decide to trade other pairs, adjust this number. This will ensure that you receive the right position size to be used on each trade. If you are trading 10 pairs, the strategy will calculate the normal position size and then divide it by 10. This will leave enough room for other trades to be opened.

Your maximum risk would stay the same but for the 10 pairs. So if all trades fail and hit your stop-loss you would lose the number in Max % risk of your total equity. If it’s 2%, then 10 failed trades would result in a 2% loss.

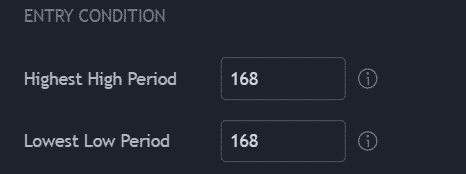

Entry Conditions

There are 2 parameters that will impact our entry:

- Highest High Period

- Lowest Low Period

Each of these represent the number of candles that we want to use for our breakout signals.

The default setting of 168 means that we will take the highest price and the lowest price of the last 168 candles. On a 1H timeframe chart, that represents 168 hours.

You can change those as you wish, a smaller number would trigger more trades but would probably have a smaller win %. A bigger number would generate fewer trades but those would most likely have better win %.

The highest high and lowest low periods do not need to be the same.

I encourage you to play with those settings to see how the backtest react to different combination on different timeframe.

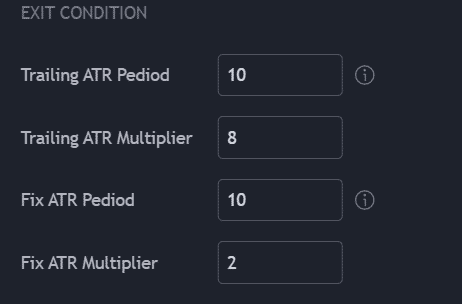

Exit Condition

Our exit condition is compose of 4 parameters, 2 for our trailing stop-loss/take-profit and 2 for our fix stop-loss.

- Trailing ATR Period

- Trailing ATR Multiplier

- Fix ATR Period

- Fix ATR Multiplier

The trailing ATR period represents the number of candles that will be used to calculate the ATR value of our trailing stop-loss/take profit. A smaller number here would generate an ATR that reacts quickly to the market volatility. A bigger number would do the opposite and generate an ATR that changes slowly because it is looking at a greater timeframe.

The trailing ATR multiplier does exactly what its name says, it multiplies the trailing ATR period. This can be useful if you do not want to get stop or take profit too quickly, it will keep the trailing ATR farter from the current price.

The fix ATR period is the ATR value that will be generated as soon as we enter a position. This parameter lets you set the number of candles back that you would like to use to generate the ATR value. Works the same as our trailing ATR except that it will keep the same value for the whole trade duration.

The fix ATR multiplier is the same as the trailing ATR multiplier. It will take the ATR value generated by the fix ATR period and multiply it by whatever you enter in this parameter. Again, it will help your fix stop-loss not get triggered too often by keeping it a little farter than the current real ATR.

Creating email alerts on Tradingview

Now that you know how the strategy works, and how to customize the settings, I will show you how to create an email alert using tradingview. This will simplify your trading as you won’t have to stare at the chart 24/7. When you need to take action, an email will be sent to you with all the information you need to open or close the position.

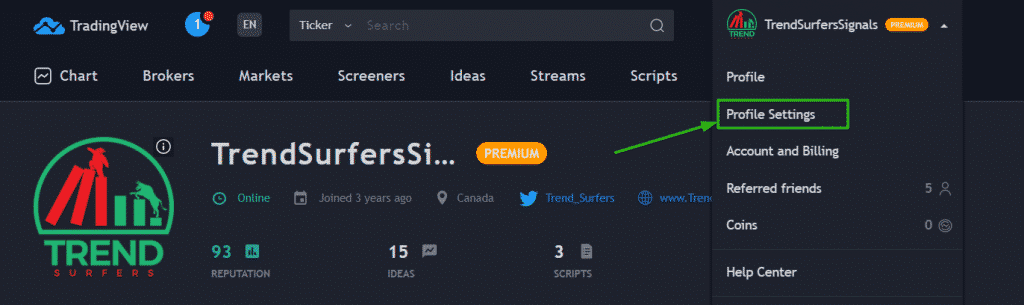

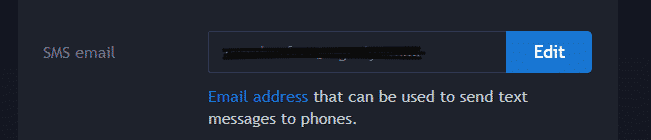

First you will need to change the Email-to-SMS parameter in your tradingview settings.

Setting up Tradingview to receive email alerts

Go to your profile settings:

Find the Sms Email parameter:

In that box, enter the email that you would like to receive your Bitcoin signal order. Make sure you go confirm the email after (go to your inbox and click the confirmation link in the email you just received from tradingview)

You can now receive all your tradingview alerts directly to your email.

After that, you will need to create an alert using our strategy.

Creating Tradingview alert based on Strategy

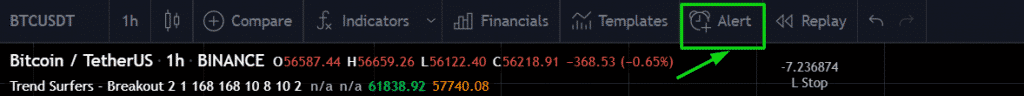

To create an alert on Tradingview based on our Bitcoin Breakout Strategy, you will have to go back to the chart screen (The one with our strategy on the chart).

Then, click the add alert button at the top of the screen:

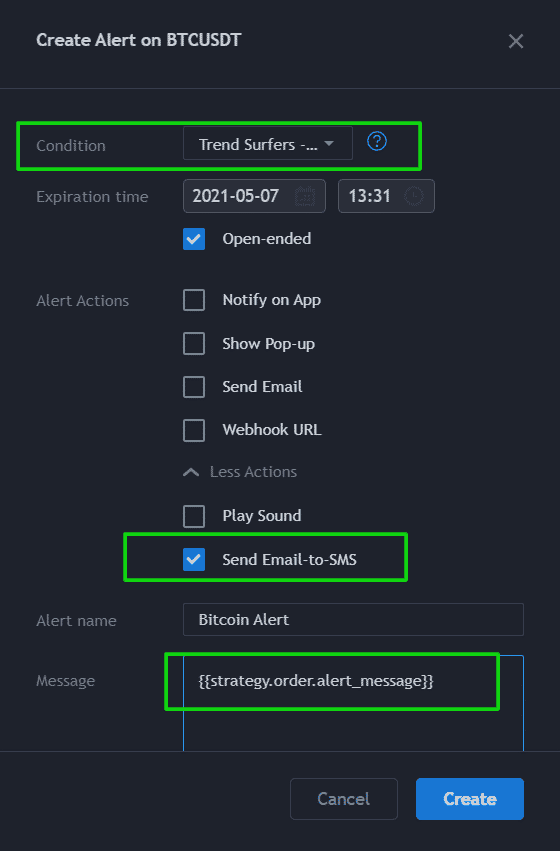

In the alert creation box make sure to enter those parameters:

- Condition: Select the Trend Surfers – Breakout strategy

This parameter tells the alert when to trigger. In that case, it will trigger when our strategy tells it to. - Alert Actions: Expand the action options and select Send Email-To-SMS

This parameter tells the alerts what to do with itself. In that case, it will send an email to the address you entered in your settings previously. - Message: Enter the placeholder: {{strategy.order.alert_message}}

This parameter tells the alert what to send. In that case, it will send you all the needed information (Entry, Stop-loss, Exit, Position size). Those pieces of information are coded in the strategy and will be sent to you in a readable way. The placeholder contains the information associated with the different orders.

That’s it! Press the Create button and you will start receiving alerts via email every time you need to take action.

Now if you would like to receive alerts for other pairs, you just need to repeat those steps.

Don’t forget to update all your alerts when you add new pairs to your trading! You should adjust the How many pairs parameter of the strategy or else you might risk a bigger amount than you intended to.

The mindset of a winning Bitcoin trader

You are all set now! All you have to do is follow the alerts that you will receive in your email. You are now a systematic trend following crypto trader! hehe

But wait, the hardest part of all is still to come! One thing could absolutely crush you when you become a systematic trader!

No worries though, I will tell you what it is and how you should deal with it. You ready?

The ONE thing that will ruin it al for you is… YOU!

That’s right, you and all your humane traits! Your FEAR! Your GREED!

So let’s make sure you don’t get too much in the way…

Be emotionless

The first step to become successful in Bitcoin trading is to know yourself! The strategy is only as good as the trader using it. Now that you are aware of that, you have to remember it when the Bitcoin strategy get into a drawdown. You have to remember why you start using that strategy.

Not every trade will be a winner, some winning trades will turn into losing trades and it will be frustrating.

You might have 7 trades or more losing in row! Are you ready for this?

If you have played a bit with the strategy and understand why it works and when it doesn’t work, it will greatly improve your confidence in it and make you a better crypto trader!

All you have to do, is execute what the alert will tell you. Don’t get personally involved. Leave your emotion out of the process!

If you don’t, you shouldn’t be trading this Bitcoin Strategy!

You can always check out my fully managed crypto signal. That way, I am doing all the mind work and you are copying every move I make automatically.

Start small! Learn the strategy, see how it works, see how you feel about it.. Once you are comfortable, you can add some more funds to it.

Have patience

The second step to be successful in Bitcoin Trading is to be patient. Many new traders think that they will get rich in the same year.

The fact is that Bitcoin trading as well as any other trading is like a marathon, not a sprint!

If you try to go too fast, you will burn your account! You will take too much risk and the market will just crush you.

This is not a get-rich-quick strategy! If this is your goal, you can go and try to pick the next NFT (or whatever is trending when you read this) that will do 1000X.

This strategy will outperform buy and hold over time. It will compound and can generate great returns. But please, don’t expect it to turn your 100$ into 100K within the next year.

That’s it!

I hope that you will enjoy that free strategy for BTC! Even if you end up not using, now you have a little idea of how systematic trading strategy can be done and how you can get alerts for them.

If you have any question about the strategy or anything that is in the article, or even just to say Hi! Don’t hesitate to leave me a comment below!

And if you enjoyed the content, I would appreciate if you shared it with your crypto friend and community!

Thanks for reading and I hope you will be successful!

i love this