Our Trend Following Strategy for Bitcoin and other cryptos

We do not try to catch bottoms or tops of the Bitcoin price, we buy when a trend is confirmed and we ride that trend until it is no longer valid. We use 3 different stop loss and take profit in order to maximize our gains and lower our risk

Here’s what you get when you follow our signals (which are free by the way):

- Entry and Exit Signals

- Adaptive Position Size (To control our risk)

- Adaptive Leverage

- 1 Adaptive Stoploss (Vary for each position)

- 1 Dynamic Stoploss (Trailing)

- 1 Dynamic Take-Profit

- 2 Pyramiding Entry (If the market goes our way to increase our gains)

- Low 15% fees on the profit only when your equity reaches a new All-time high!

This strategy adapt with the volatility of the market to guarantee that we control our risk at all time.

Compound the winners

Our signals will automatically allocate a percentage of your portfolio for each trade instead of a fixed amount like many do. This allows us to compound our gains. If you use our service for a few month, you will see the position sizes grow as your equity get bigger.

Aim for the MOON

Unlike other signals services that often aim for many small gains and a high winning ratio, trend following have many small losses and about 35% of winning trades. But those winning trades are big enough to cover all the losses and make us big profits.

Drawdowns

You must know that our strategy will have drawdowns (drop from our all-time high) of about 20 to 25%. All trading strategy have drawdowns, it’s just that most traders decides to not share it with their customers and blame the market later for it 🙂

Those drawdowns will occur from time to time during a ranging market, usually smaller than the 20-25% mention above as those are in a worst-case scenario.

Kill the losers

Many signal providers do not use Stop Loss or use a fixed % as a stop loss. Trend surfers use dynamic SL that follows the price. The result is that we cut our losses very quickly if a trade doesn’t go our way. Failed trades can result in a maximum loss of -0.4% (if no pyramiding has been made) to around -0.6% if we did pyramid and the market turn on us very quickly (very rare)

Risk Management

- Our strategy uses 2 stop losses, one is fixed and the other is a dynamic trailing stop loss that reacts to the market conditions.

- Our position sizing is dynamic, adapting to the market volatility.

- Our maximum risk per trade is 0.4%.

How to surf the trends with our signals

It is important that you understand before using our signals, that only around 30% of our trade signals are winners. It is also important to understand that it doesn’t mean that you will win 3 out of 10 trades but 300 out of 1000 trades should be winners. The more trades that are done, the more the stats will be accurate. For this reason, we suggest that if you follow our signals, you should do it for at least 6 months.

You need to trust our strategy. There will be losing trades. But remember, those losing trades are tiny compared to the winning ones. The reason there are so many losing trades is that we receive many false signals during ranging markets. We trade in and out following the price.

The reason why we don’t need more than 30% winning trade is that when we catch a trend, especially in crypto, we can ride it 50%, 70%, or 100+%. Those easily beat the losing trade of 0.4%. So don’t panic if you have 10 losing trades in a row. You just need 1 winner to bring you to the moon. Let the strategy run itself, do not interfere.

You need to trust and let the strategy do what it is made to do. That might take time. But your patience will pay.

Backtested for the best results

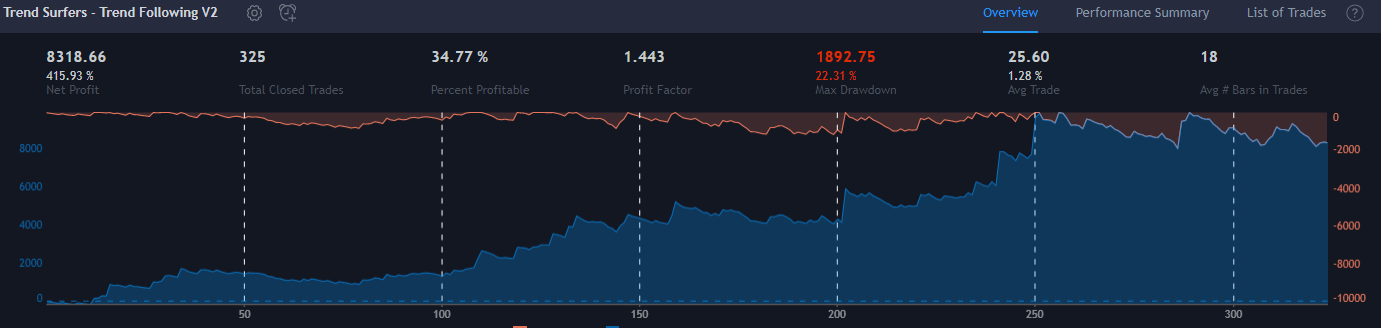

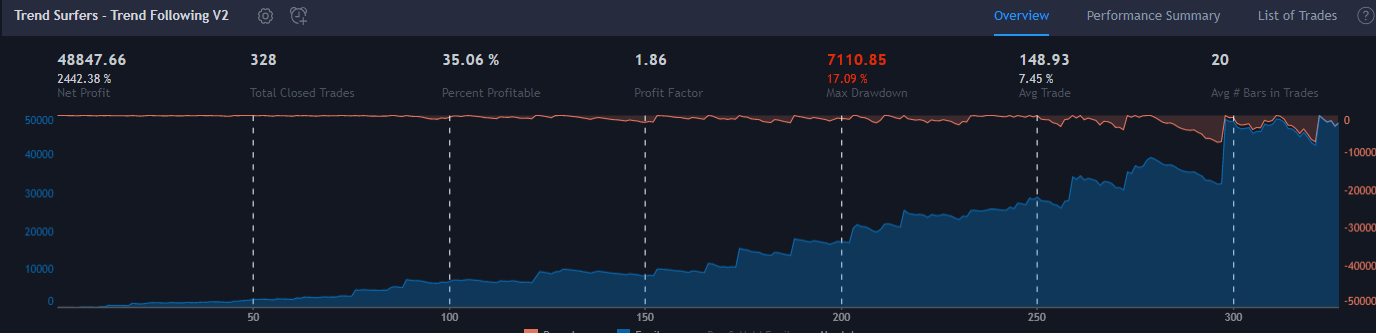

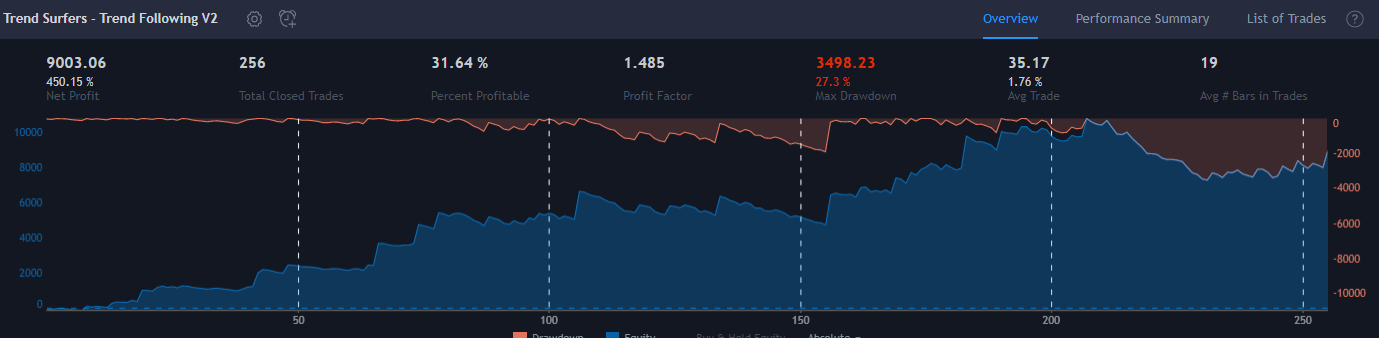

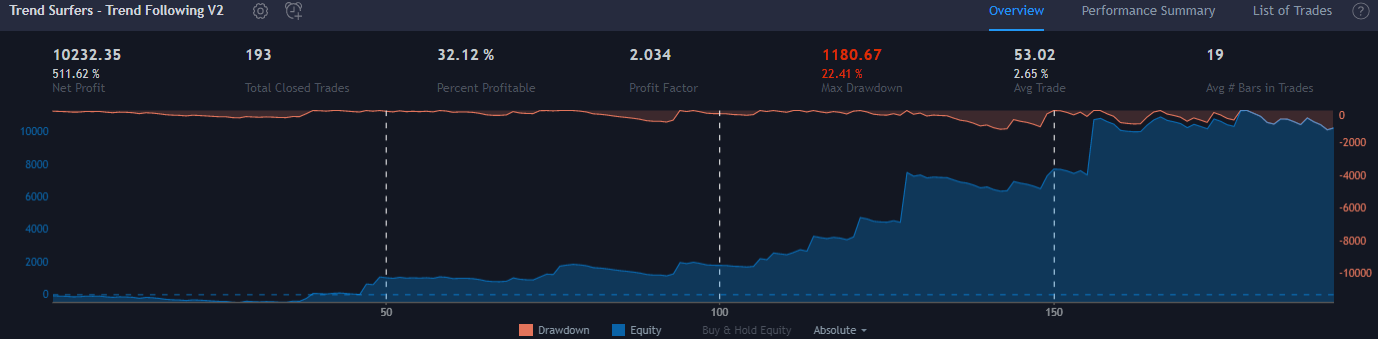

Here’s the backtest from 5 of our 15 traded pairs:

The strategy has been updated since the backtest, but they remain very similar except that our winnings are now about 5X more than before.

Profitable Trades

You might think that 33% profitable trade is very low and you are right! But this is more than enough to give us a huge ROI per year.

Most signals providers try to attract customers with 96%+ winning trades, but what these don’t say, is that often they don’t use a stop loss (keep their trade open forever and don’t calculate it in their results), or they have many small wins and huge losses.

We do exactly the opposite of them, we have 2 tight stop-loss (which result in many small losses) and we let our winning trades run until the trend dies (which results in massive winning trades).

Buy & Hold is a terrible strategy

Unless you are in a bull market, buying a coin and holding it long-term won’t do anything good to your account. Another thing is that bull markets DO NOT LAST FOREVER. We follow the trend, up or down. The only time we are not growing our account is in a ranging market.

Check out our Bitcoin buy and hold VS Bitcoin trading article to see how trading increases your return over time. In this article, buy and hold is compared to a very basic trend following strategy. The strategy used for our automated copy-trading signals is highly superior to it.

Trend Following

Please note that these stats are what you can expect from any trend-following strategy. The ROI may differ, but the drawdown and % of winning trades are always around these numbers. The choice is yours if this strategy fits your disposition or not.

Trend Surfers on Zignaly

Zignaly is a signal platform that allows you to choose between multiple signal providers to automatically trade using their signals. One of the easiest ways to automate your trades.

Trend Surfers offers 2 Strategies to trade Bitcoin and other cryptos on Zignaly which are based on a profit-sharing model. So it is 100% free to follow our signal and we take a share of 15% of the profit (So let’s say 85% free 😉 ).

The success fees are only taken once your equity reaches a new all-time high! So if you don’t make any money, we don’t either.

If you are interested in joining our services, you could be connected and receiving your first signals within 10 minutes. Simply follow to steps on How to setup Zignaly signals.

If you need any help, don’t hesitate to contact us via email or on our Discord channel.