After seeing the love of new investors towards scalping trading style and also how most of the ones available on Zignaly were putting investors’ funds at liquidation risk, I decided to create a safer scalping signal. A scalping signal that would protect investors’ funds, while generating a very interesting profit.

This strategy goes against Trend Following (which is usually the type of strategy I develop) as it is Buying Bitcoin or other cryptos while they show signs of weakness. Buying on weakness means that the lower the price, the better your buying signal is. This is the reason why lots of providers on Zignaly are risking to liquidate investors’ funds.

They will Buy and DCA a falling Coin usually with leverage. When the Coin doesn’t recover quickly enough, the account will most likely get liquidated after a couple of drops in price. If it doesn’t get liquidated, investors might see their funds being frozen for weeks or even months until the provider closes the position in profit (because most won’t close at loss)

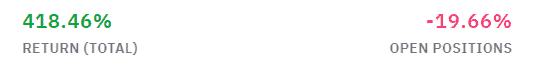

Example of a service that doesn’t close losing position (been in a -20%+ open drawdown for weeks)

The Reversion scalping signal I created is not like that. Every position we take has stop-loss and a timer that ensures that our positions are never open more than 24 hours. The strategy also uses 1 DCA. I believe that if the position doesn’t recover quickly, I don’t want to be in it and I prefer to wait for the next position.

Buying the Dip

The main goal of my Reversion signals is to buy the dip and quickly close the position in profit. Sudden price drops are very common on the chart. The strategy will get any price drop that is out of the “normal volatility” for any crypto asset.

More often than not, a quick move down in the price will be followed by a reversion and the price will go back toward the mean (the average recent price of the crypto asset).

The Reversion strategy will then close the position with a small profit or loss and wait for the next signal.

Quick Profit on Crypto movement (Scalping Crypto)

The Reversion signals will secure profits very quickly.

Our positions are never open for more than 24 hours (Most of the time way less than that).

Some trades are closed within a few minutes.

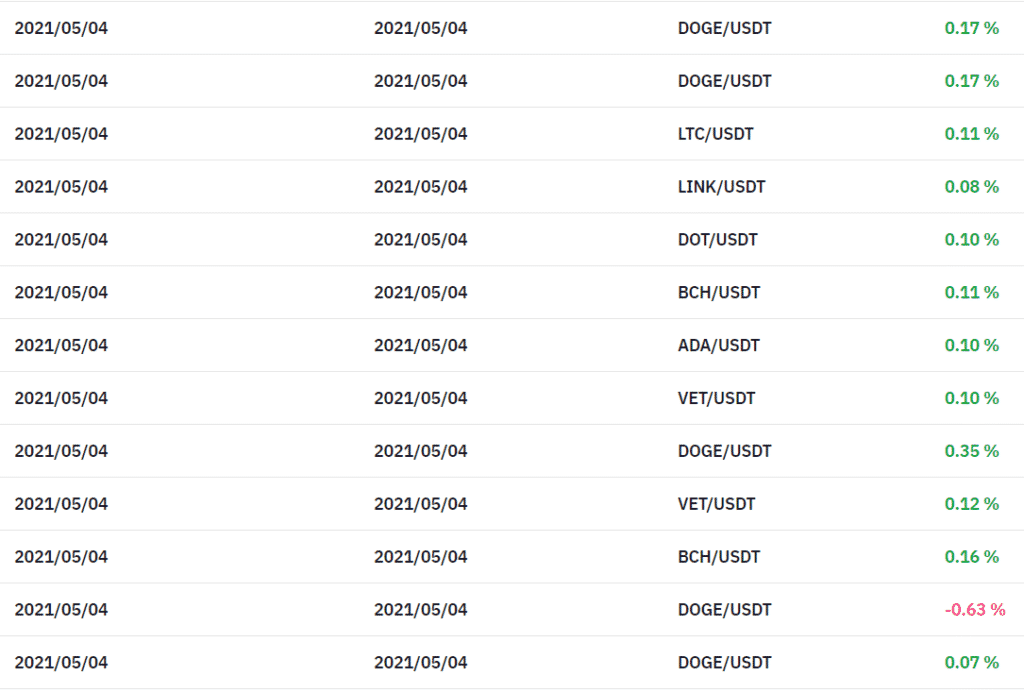

The signal will secure a small profit on most of the positions (about 75% winning positions). The small profits of 0.03% to 0.05% of our total portfolio will add up and start compounding. It won’t take very long to notice the snowball effect in your portfolio.

PS: The screenshot below was taken when our strategy traded fewer pairs. Now that we trade over 20 pairs, the position size is smaller on each position, so is the return on equity. But we have more positions.

Reversion Strategy Specification

The buying signals for the Reversion strategy are composed of 4 main elements, the buying trigger, a DCA (Dollar-Cost Averaging) buy, the stop-loss, and the hard time-based exit.

Each of these elements has its role to play.

Buying the dip

This is the buying trigger. Our strategy is watching the crypto market 24/7. Calculating the volatility of the market.

If a sudden drop in the price happens, which is out of our volatility range, a buy signal will be triggered.

Most of the time (50+%), the price will reverse in such a movement. The price will then hit our take-profit target and a signal will be sent to close the position.

But even if we usually close in profit very quickly (Few minutes to few hours). The price drop will sometimes get lower than our entry, the price will keep dropping.

This is where our second element will come into play.

Re-Buying the dip: Dollar-Cost Averaging

When the price keeps dropping away from our entry, our first safety net is a DCA signal. This helps to lower our entry price and at the same time brings our take-profit closer to the current price.

Doing a DCA helps us to close in profit. Based on the fact that the first drop in the price was already out of the expected price range. An extension of that drop is unlikely and buying it when it happens, will increase our overall profit due to the DCA increasing the position size.

But remember, the crypto markets, or any other markets for that matter, do not always behave rationally. Markets are driven by human emotion, greed, and fear. So we cannot assume that because the price is dropping more than it should have, that it will go back up 100% of the time.

Sometimes, the crypto market will just keep dropping, and dropping, and dropping some more…

This is why our third element is a crucial part of the Reversion strategy.

Stop-loss: Because we can’t predict the future

When the market doesn’t reverse, we cannot just stand there and watch our position get crushed. Yes, the price might reverse right where our stop-loss is. But it is important to set a limit to our losses.

Many new traders do not use stop-loss and you can see them easily with huge negative open positions (-30%+).

While a position is open, it locks the capital from entering another position. If a position is not going our way, there are no reasons to leave it open. We could just close it and put our money to work somewhere else.

I don’t want to predict where the bottom is, I want to make money!

This is why that if a position drops too much against our initial buying price, the position will be exited with a loss. This will free our funds, make us exit a potentially bad situation, and we can move on to make money instead of waiting forever.

Talking about waiting forever, this is another thing that our Reverse signals will keep you away from by using our fourth element.

24 Hours Limit: Because markets evolves

The crypto markets are constantly changing, from bull markets, to bear markets, to sideways. Price fluctuation will also change very often, from a big swing to almost stable coin status.

This is why all of our signals expire after a maximum open time of 24 hours.

If a position did not hit our take-profit target or our stop-loss after 24 hours, it will be automatically closed.

And why not! Clearly, the strategy got a false signal here. The market should have recovered or fall at that point.

We can only assume that the strategy was off on that position or that the market dynamics have changed. Either way, it means it’s time to get out and leave the place for another trade opportunity. This is scalping, not holding…

The 24 hours limit also solves a problem that many investors have on Zignaly profit-sharing. That you can only disconnect from a provider once all the positions are closed.

You can now have the peace of mind that your funds will never be stuck when using those scalping signals.

Backtest & Forward testing

Let’s get to the interesting part, how much money can we make with these crypto scalping signals?

First, let’s just make it clear that the Reverse strategy doesn’t only go up and win trades, there will be losing trades. There will also be streaks of losing trades causing drawdowns (drop from equity all-time high).

The settings for our Strategy:

- Take profit = 1.5%

- Stoploss = 5%

- Position Size = 1.85%

- DCA Size = 100%

- Max DCA = 1

- Leverage = 2X

- Pair Traded = 25+

- Max Investment = 198%/equity

The Stoploss and Take-profit in the zignaly dashboard are only there as a safety net, this is why they are bigger than what is mentioned above. Our strategy will send a signal to close the position. If those signals fail, the % of SL and TP on Zignaly will apply.

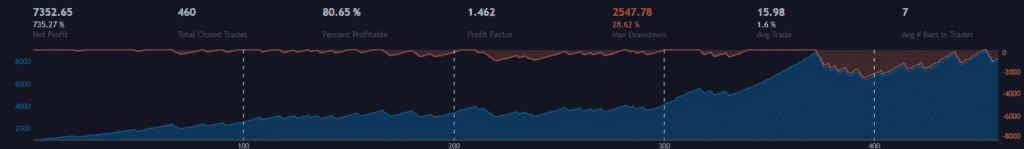

Backtest results

Below is one of our trading pair (Ethereum) backtest results for a 1.75 years period. You can see that it is not a smooth ride, but it does generate profit while keeping your funds away from liquidation. It also outperforms buy and hold for that period.

Signals are sent for over 25 pairs currently which aims to create smoother returns and drawdowns (less choppy).

By combining the 25+ pairs, the backtest results are as follow:

- Max drawdown for 1.75 years is around 30%

- % returns for the period is around 450% (approximation as some pairs traded don’t have lot of historical data)

- Our winning % is around 75%

- Average of 16 trades per day (this is an average, I can see from the backtest that they are not evenly distributed and some days are very quiet and other packs with trades.)

Automate this BTC scalping strategy

You can use this strategy with the Zignaly Profit-Sharing program. The success fees are 20%. ( There are currently no fees as our returns are in the minus. Fees will start when we return to positive)

If you are already registered on Zignaly, you can join us directly at https://zignaly.com/app/profitSharing/607c82c51f6b99363c42a94b

If not, you can refer to our guide on how to get started with Zignaly profit-sharing.

Once you are connected to our Reversion service, you will automatically copy every new signal 24/7. Trades will open and close by themselves, all you have to do is wait and watch!