Table of Contents:

Copy-trading or social trading for cryptocurrencies like Bitcoin and Ethereum is getting more and more popular. This is very good for the new investors as it can produce greater returns than simply buying and holding, and also protect you in case the crypto market decides to crash again. And it will 😉

The problem is, many of the new crypto investors using copy-trading services, lose money and sometimes they lose all their money! So I will tell you here why lots of investors are getting rekt using these services and also what you should do to make money using crypto copy-trading.

First, let me explain to you the process of it.

How does it work?

There are many kinds of copy-trading systems out there, but today I will use the profit-sharing model used on Zignaly as it is the easiest to use and follow when you are beginning with crypto trading.

So basically, to copy every trade from a profit-sharing service, you will register on the Zignaly platform, transfer some USDT in your Zignaly wallet and then head to the Profit-Sharing marketplace and select the top trader on that page. Et voila! You are on the path of getting your equity destroyed!

Really, it is that simple to start copying every trade from a copy-trader on Zignaly. And it is also that easy to lose all your funds. Now, I will make sure that the ‘Equity destroyed’ part never happens to you.

Making money using Zignaly profit-sharing or any other social trading platform is more than possible. It is actually very easy. But very easy doesn’t mean that you will have nothing to do but select the top traders.

You will need to do research on each of these services. It won’t be hard to do, but you need to do it. Unless you don’t care about your funds.

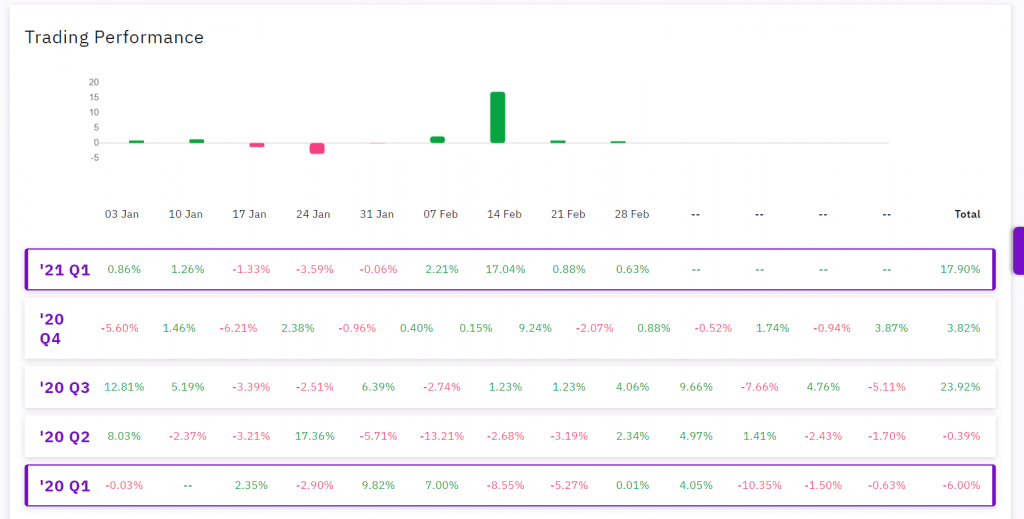

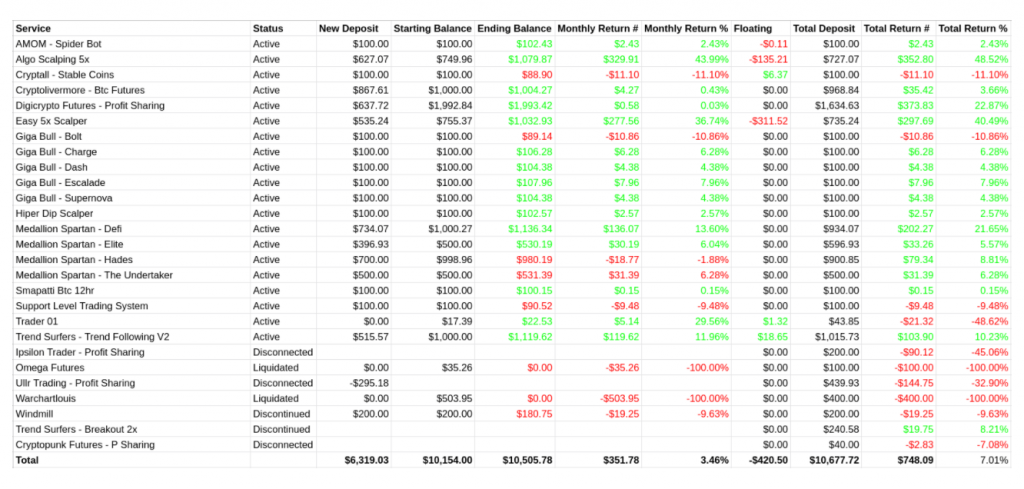

A great example of copy-trading success is the monthly post by Bart (Zignaly CEO) that copies over 20 services on the platform and posts about their results and his overall results each month.

It shows that diversity helps and that the top traders at X moment might be the worst a week later.

Here are some returns analytics from my Trend Following V2 provider, this strategy has been running for over a year now with success:

Why do a lot of people lose money with copy-trading?

As easy as copy-trading can be, a lot of crypto investors will lose their money using those platforms. Like mentioned before, it will sometimes be due to selecting the best trader of the moment that ends up getting liquidated a few days after.

Investing all your funds into one trader can also create disastrous results. Other main issues like stopping to follow a trader because he has a drawdown or not reading first what the service provider warns about in his service description will also lead to your fund’s loss.

Lets see each of these point and how they can affect your trading returns.

Selecting the best performing crypto trader right now

This is the most common reason why investors loses money using crypto copy-trading services.

Copying the best services at the moment doesn’t mean you will do good. There are many new services that join at the perfect moment.

I don’t know if it is on purpose or it is just luck but I have seen many services getting listed on the platform and being at the top spot or near it from the beginning.

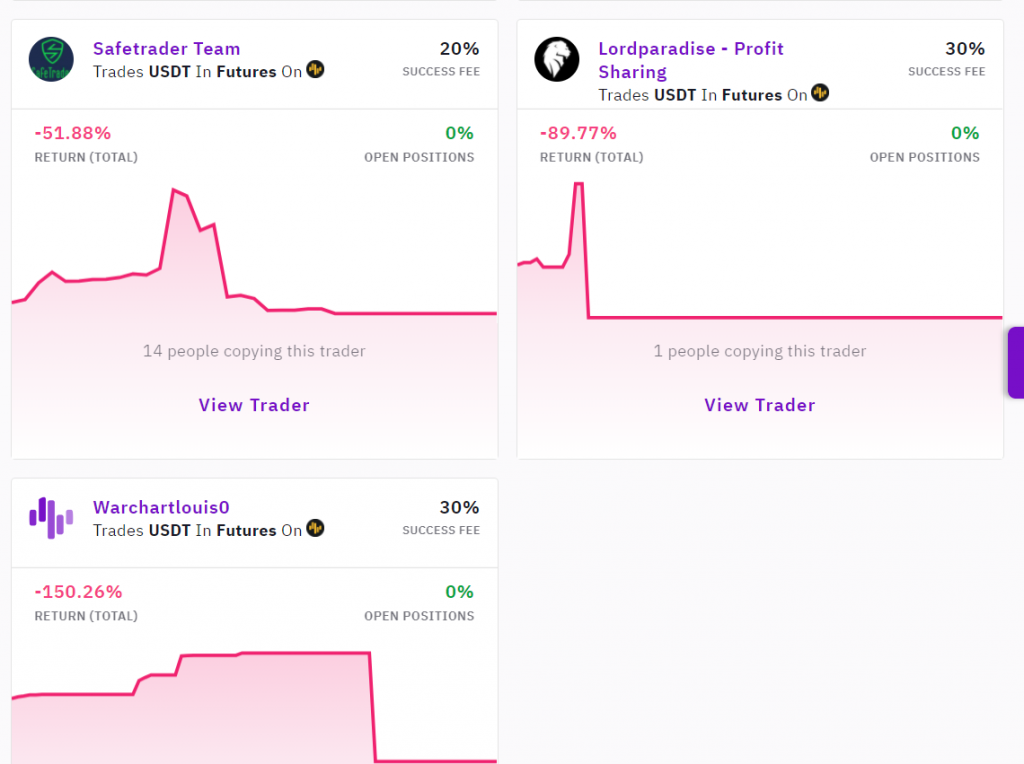

This creates hype, a new top trader is in the place! Everybody jumps on it, the FOMO is real. Investors put all their money into it because it joined the platform and it is at 200% of profit in 2 weeks!

Then the market turns, the provider is down 20%, he doesn’t close the losing trades because he needs to preserve that nice 45-degree angle equity growth chart.

Oops! The market keep dropping, that 20X leverage trade is not in a good shape now, you are -75%.

You are starting to panic, you go to the provider and ask what is happening. The answer will probably to blame the markets or some weird news like the Chinese new year or something.

The next day, the market has one more drop, you are liquidated. The crypto trader you were copying, that #1 trader with a full team, and A.I super trading system from outer space is gone and your money is gone too!

This is caricatural, but still not very far from reality. It doesn’t mean that all the top crypto traders will make you lose money, it means that you should not jump on the top ones because they are at the top but because you did your research and you know why they are at the top.

These charts were very appealing for new crypto investors looking to get rich quickly. Together, they liquidated more than 300K USDT. Think about this next time you are fomoing.

Over investing in one copy-trading service

The second most important factor of losing money with crypto copy services is that many will put all their eggs in the same basket. It is so basic, but it will keep happening over and over.

It is another FOMO (Fear Of Missing Out) behavior that goes hand in hand with our first reason (Jumping on the top trader).

It is all caused by greed, the investors see those incredible returns and start to think that if he puts all his money, in this single provider, by Wednesday next week he should be sitting on a yacht.

Geez, in a month he will probably be on one of the spaceX ship!

Let’s go all-in! Then the same story happens, few weeks, or months later he is way under his initial investment.

This is when the 3rd most common mistake can happen, he decides to leave the service. He can’t take it anymore.

Stop copying underperforming services

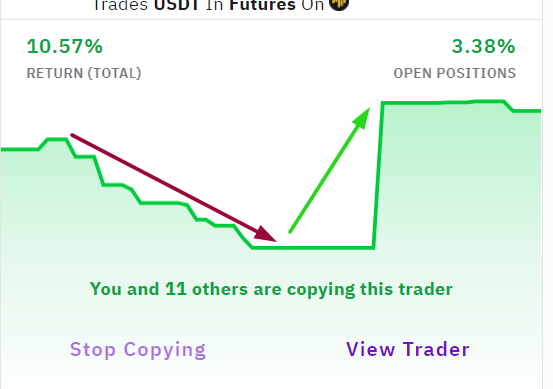

So the crypto trader is not performing well lately. You are -10% on your investment. You decide to stop copying that crypto trader because it should only go up, right? And it doesn’t, right? 🙂

Once, you stop copying his services, you keep an eye on his stats, just to convince yourself that you have made the right move.

3 weeks later, he is now +45% from where you left!

He must be back on track! You jump right back in, convinced that you will regain that 10% that he made you lost.

Oops! Another 3 weeks later he is down again for 10%. He now made you lost 20% of your funds! You quit, why would you stay with him, clearly he is unstable and he probably just had some luck to get this +45% return.

3 weeks later, he is up 20% from where you left.

Get the idea? Drawdowns are a normal part of any trading strategy. If a crypto trader is trustful and warns you about possible drawdowns, those negative ROI periods should be a time where you add funds. By removing your funds and coming back only when things are good, you are running after big trouble.

Ignore the provider’s advice

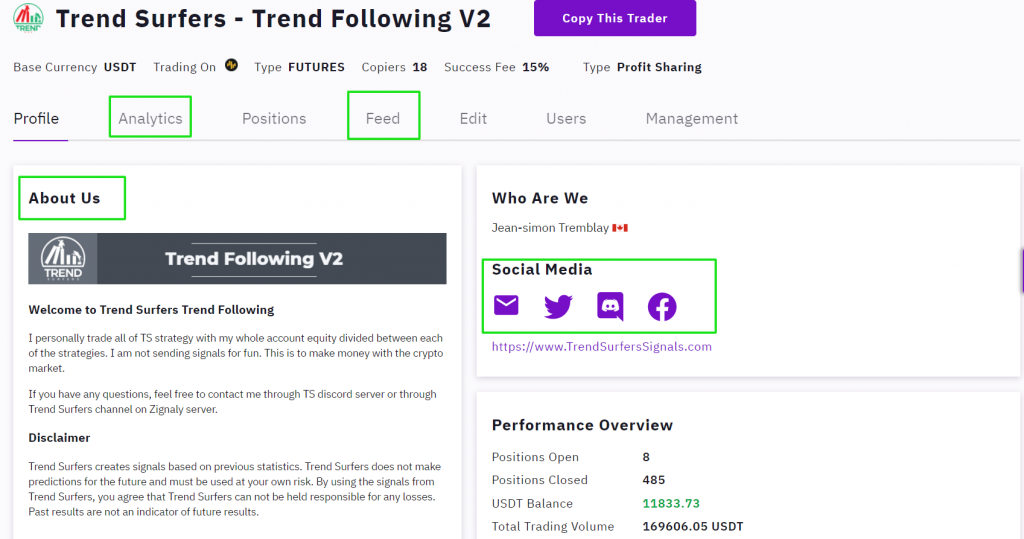

Every crypto traders that add their services to a copy-trading platform have the chance to describe how their service works and what to expect from their trading strategy.

It is YOUR duty to read those descriptions and make sure you understand them.

Copying a trader blindly will eventually lead you to one of the 3 other reasons for losing money mentioned above.

If the provider is too lazy to provide an accurate description of his services, wouldn’t that be a red flag?

How to make money with crypto copy-trading

Now that you know what not to do when starting in the copy-trading world, let’s go on the good side of crypto copy-trading. MAKING MONEY!

Do your research about each one of them

In order to make money with crypto trading services, you will need to research every service that might be of interest.

Make sure you read all their descriptions, check their stats closely, what kind of leverage they use, do they use a stop-loss, how long do their winning trades stay open, how long do their losing trades stay open, what kind of drawdowns the strategy will produce and so on.

The more you know, the better, if you don’t have all the information, make sure to reach out to them and ask. After all, you are investing in their services, the minimum they can do is explain to you how it works.

You should have some contact information on their service page.

Doing in-depth research before copying a trader will greatly increase your success because you will not be fearful of the strategy. If you are confident, you won’t leave them as soon as there is a drawdown.

Invest a little and see how it goes

Start small, just like a trader would learn how to trade, you need to learn how to be a good profitable copy-trader. With the profit-sharing service offered on Zignaly, you can start with a very low USDT amount.

Why not start with 10$, get a feel of how things are going, see how you are doing and what kind of emotion might get in your way if you had put 1000$ or even 10K on that service.

That will increase your confidence in the service and might help with your FOMO, as you will be in the game. You will still need discipline to not throw all your money at it if it goes well.

Think about that: If the trader is really that good, why would you FOMO? After all, a great trader will still be there in a month, 6 months, or 2 years. He will be making money constantly. Why not test it with a low amount for a month or 2. Best case, he is a top trader and you will be able to follow his calls for years to come. Worst case, he blows up the account, and all you have lost is 10$.

Think about it! Control yourself!

Add funds during a drawdown

Once you start copying one of the traders you research, and he is solid. You will know about those possible drawdowns, right? Because you did your research right? OK.

So you got full confidence in the strategy, you know that this copy service can have 25% drawdowns from time to time.

Once you are in a 20% drawdown, your best move should not be to leave the service, it should be to add funds to it.

Because you now know that you are close to the maximum expected drawdown, you are already down 20% why not add 20-30% to the provider?

This will make you even and when he starts making money again, you will do even more. See it as a dollar-cost averaging on the copy-trading service.

You can always remove those added funds + the profit from it once the equity curves get back to even.

You don’t need to add funds on the drawdown if it makes you uncomfortable. But if you trust the trader, at least, stay with him some more as the pain will soon come to an end.

Stop copying only if the drawdown exceeds the maximum expected drawdown by 5-10%. As markets are changing, history is created. But a robust strategy should give results that are very close to their backtest.

Stay in touch with the service provider

To avoid any confusion and bad emotions, you should stay in touch with your service provider. Especially when the strategy is not working so well. Ask him any questions you might have, tell him about worries you have.

But in no way, ask him to change something or close one of his trades. He is fully aware of the situation and he probably has more faith in his strategy than anyone else.

He is there to explain what is happening and what you should expect in the short and medium-term.

By contacting the provider, you will also get a feeling of how things are really going and if everything is under control. From there, you will make better decisions as to what you really want to do next.

Copy different crypto-traders

Once you have done your research on all the traders that look decent, the best move would be to look at their equity growth chart and see if you can find uncorrelated charts amongst your top crypto traders list.

You can then distribute your equity between them, allocating less to the riskier traders and more to the ones showing great risk management. A 70/30 split (Conservative/Risky) could be a good way to start, but this is obviously up to you and how much risk you can tolerate. Personally, I wouldn’t put more than 10% in high-risk services for the same reason that I don’t buy lottery tickets every week. I want to see great control over risk.

Check out the study done by Bart (TOLE) about copying multiple profit-sharing services to create a passive income.

Here’s a preview:

Checklist for success in copy-trading

- What kind of return can you expect from the copy-trading service? (Daily, Weekly, Monthly?)

Knowing this will keep you away from getting impatient, it is normal that a copy-trading service that trades on a 4H chart doesn’t give you daily returns. - What kind of drawdowns can you expect?

Many crypto copy-traders will not share this information. Sometimes it’s because they have no idea, sometimes it’s because they know very well that nobody would copy them if they knew the numbers. If it’s not available, reach to the provider and ask for at least 2 years of backtesting. If they can’t provide this to you, stay away no matter how good they can look. - Find uncorrelated crypto-traders

By copying many uncorrelated traders, you will reduce your risk and have a smoother equity curve. - Split your money wisely between each crypto-traders

After investigating each provider, you will have a good idea of how risky each of them is. You should allocate your funds accordingly, meaning that riskier traders should have less allocated to them than the safer ones.

I hope that this will help some of you to survive in the cruel world of crypto trading! Social trading can be very beneficial, but it is not as easy as it may seem. Do your homework! Let me know your tricks to not get rekt in the comment!