Table of Contents:

Overview

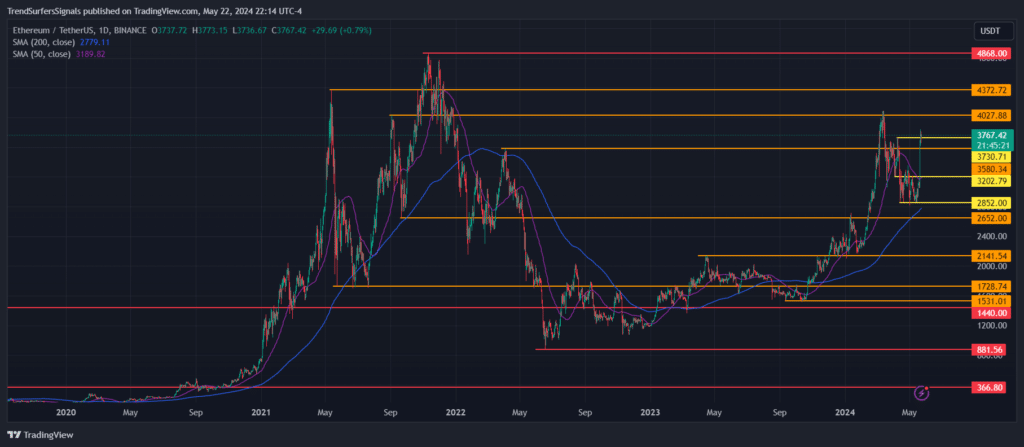

The charts show the price movement of Ethereum (ETH) against Tether (USDT) with key support and resistance levels highlighted.

Key Levels

- Monthly Support and Resistance (Red)

- Resistance:

- 4868.00 USDT: The highest significant resistance level on a monthly scale.

- Support:

- 1440.00 USDT: A crucial monthly support level.

- 881.56 USDT: Another significant monthly support level.

- 366.80 USDT: A lower monthly support level.

- Resistance:

- Weekly Support and Resistance (Orange)

- Resistance:

- 4372.72 USDT: A higher weekly resistance level above the current price.

- 4027.88 USDT: A significant weekly resistance.

- 3730.71 USDT: Currently tested weekly resistance.

- Support:

- 3580.34 USDT: A lower weekly support level.

- 3202.79 USDT: Another strong weekly support level.

- 2852.00 USDT: A significant weekly support level.

- 2652.00 USDT: Lower weekly support level indicating a strong base.

- 2141.54 USDT: Another important weekly support level.

- 1728.74 USDT: A lower weekly support level.

- 1531.01 USDT: Another significant weekly support level.

- Resistance:

- Daily Support (Yellow)

- Support:

- 2852.00 USDT: A daily support level.

- 2652.00 USDT: Another lower daily support level indicating a strong base.

- Support:

Moving Averages

- 200-day Simple Moving Average (SMA) at 2779.12 USDT: Indicates the overall long-term trend.

- 50-day Simple Moving Average (SMA) at 3189.87 USDT: Represents the medium-term trend.

Trend Analysis

- Upward Movement: The recent price action shows a strong upward movement breaking through several resistance levels.

- Consolidation: The price previously consolidated within the range of 2852.00 USDT to 3202.79 USDT, building a base for the recent breakout.

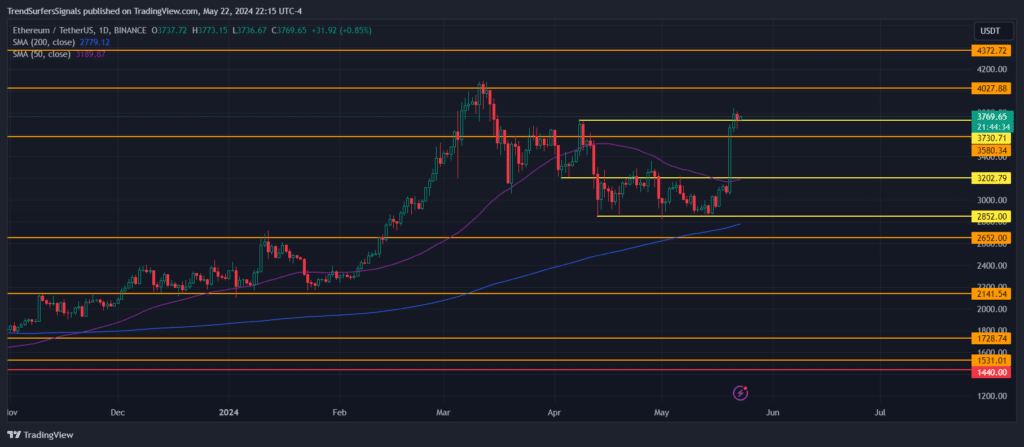

Recent Price Action

- Current Price: Approximately 3769.65 USDT.

- Last Month’s Movement:

- Bullish Momentum: Over the past month, Ethereum has shown significant bullish momentum, moving from around 2852.00 USDT to its current level.

- Breakout: The price broke out from the consolidation range, moving past key resistance levels at 3202.79 USDT and 3580.34 USDT.

Potential Scenarios

Bullish Scenario:

- Sustained Breakout:

- If the price holds above 3730.71 USDT, it could indicate a continuation of the bullish trend.

- The next targets could be the weekly resistance level at 4027.88 USDT and potentially the higher level at 4372.72 USDT.

- Support Retest:

- The price may retest the recent breakout level at 3730.71 USDT or the support at 3580.34 USDT before continuing upwards.

- Successful retest and bounce would confirm bullish strength.

Bearish Scenario:

- Failure to Hold 3730.71 USDT:

- If the price fails to hold above this level, it could indicate a potential pullback.

- The price might drop to test the support levels at 3580.34 USDT and 3202.79 USDT.

- Break Below Support:

- If the price falls below the support levels, the next targets would be the lower support at 2852.00 USDT and potentially the 200-day SMA at 2779.12 USDT.

Conclusion

For the upcoming weeks, monitoring the 3730.71 USDT level will be crucial. A sustained breakout above this level could indicate further bullish momentum with potential targets at the higher weekly resistance levels. Conversely, failure to hold this resistance could lead to a pullback towards the mentioned support levels. The recent upward breakout suggests a strong bullish trend, but caution is advised around key support and resistance levels.